Introduction

When it comes to housing decisions, one of the most important financial considerations is the relationship between rent and home value. Whether you are a tenant deciding if renting is cost-effective, a landlord determining competitive rental rates, or a real estate investor evaluating returns, understanding rent as a percentage of home value provides powerful insights. This metric not only helps in comparing rental and ownership costs but also serves as a benchmark for affordability, investment potential, and long-term financial planning.

In many housing markets, this percentage is used as a quick indicator of whether a property is fairly priced, overpriced, or undervalued in terms of rent. By learning how to calculate, analyze, and apply this ratio, individuals and businesses can make informed housing and investment decisions.

This article explores the fundamentals of rent as a percentage of home value, why it matters, the factors that influence it, and how to use it effectively in real-world scenarios.

What Does Rent as a Percentage of Home Value Mean?

Rent as a percentage of home value is a formula that compares the annual rental income of a property with its total market value. It essentially answers the question: If I rent this property instead of buying it, how much am I paying relative to what the home is worth?

The formula is straightforward:

(Annual Rent ÷ Home Value) × 100 = Rent as a Percentage of Home Value

For example, if a home is worth $250,000 and rents for $1,500 per month ($18,000 annually), the ratio is:

($18,000 ÷ $250,000) × 100 = 7.2%

This means tenants are paying rent equal to 7.2% of the property’s total value every year.

Why Is This Ratio Important?

1. For Renters

Renters can use this percentage to determine if the rent they are paying is fair compared to the property’s market value. A higher percentage could indicate overpriced rent, while a lower percentage might suggest a good deal.

2. For Homebuyers

Buyers can compare rental costs with potential mortgage payments. If rent is significantly higher than the cost of ownership, buying may be more cost-effective in the long term.

3. For Landlords and Investors

Real estate investors often use this ratio to assess rental yield. Properties with higher percentages typically generate better cash flow, making them more attractive for rental investments.

4. For Housing Market Analysis

Economists, policymakers, and analysts often track average rent-to-value ratios in different regions to understand housing affordability, demand trends, and potential housing bubbles.

Typical Ranges for Rent-to-Value Ratios

The ratio varies widely depending on the housing market, city, and property type. However, general benchmarks exist:

2% or less: Usually indicates low rental returns. Common in luxury properties where home values are high but rents are relatively lower.

3% – 5%: Considered average in many stable housing markets.

6% – 8%: Often signals strong rental yields, common in affordable housing areas with high demand.

9% or more: Typically associated with high-demand rental markets or undervalued properties.

Understanding where a property falls within these ranges helps all stakeholders evaluate financial efficiency.

Factors Influencing Rent as a Percentage of Home Value

Several elements determine whether rent is high or low relative to home value:

1. Location

Urban areas with high property values usually show lower percentages because rents do not increase as quickly as home prices. In contrast, rural or suburban areas may offer higher rental yields.

2. Supply and Demand

Markets with strong rental demand, such as cities with universities, job hubs, or tourist attractions, often command higher rental rates.

3. Property Type and Size

Smaller apartments and multi-family units usually generate higher rent-to-value ratios compared to luxury homes or large single-family houses.

4. Economic Conditions

Inflation, interest rates, and wage growth impact both housing prices and rental affordability.

5. Regulations

Rent control policies can cap rental increases, lowering rent as a percentage of home value.

Comparison Table: Rent-to-Value Ratios in Different Scenarios

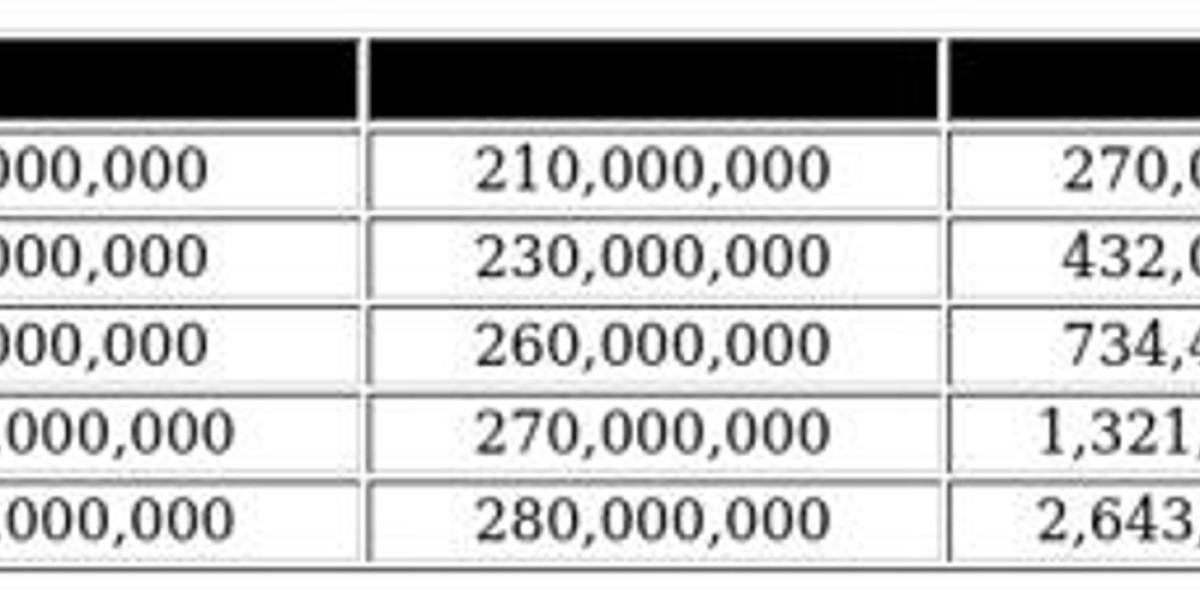

Scenario | Home Value | Monthly Rent | Annual Rent | Rent as % of Home Value |

Luxury Home in Urban Area | $1,000,000 | $3,500 | $42,000 | 4.2% |

Mid-Range Suburban Home | $350,000 | $2,000 | $24,000 | 6.8% |

Small Apartment in City Center | $250,000 | $1,800 | $21,600 | 8.6% |

Rural Home | $200,000 | $900 | $10,800 | 5.4% |

Student Rental Near University | $150,000 | $1,500 | $18,000 | 12% |

Analysis of the Table

The table shows how market conditions and property type affect rental percentages:

Luxury homes often have low rent-to-value ratios because their prices rise faster than rental demand.

Mid-range suburban homes balance affordability and demand, producing moderate yields.

Small apartments in city centers and student housing near universities often command higher percentages due to demand pressure.

Rural homes fall in the middle, offering steady but not excessive rental yields.

For investors, properties in the mid to high range (6–12%) are often the most profitable, while renters should evaluate whether paying such percentages offers long-term financial sense compared to homeownership.

Practical Tips for Renters and Buyers

For Renters:

Compare Rent to Local Home Values – Check whether the rent you’re paying is fair for the area.

Evaluate Long-Term Affordability – If rent is significantly high, calculate whether owning could save money.

Negotiate Based on Value – Landlords may be open to negotiation if rent is higher than average percentages.

For Homebuyers:

Use Rent-to-Value as a Benchmark – If renting costs more than 6–8% annually, buying might be more cost-efficient.

Consider Future Value – Homes in areas with rising demand may appreciate, lowering effective cost over time.

Factor in Expenses – Ownership comes with taxes, insurance, and maintenance, so compare thoroughly.

For Investors:

Target High-Yield Properties – Look for percentages above 6% for stronger rental income.

Balance Risk with Location – Higher yields in unstable markets may carry greater risks.

Account for Expenses – Ensure that net rental yield after maintenance and taxes remains profitable.

FAQs About Rent as a Percentage of Home Value

Q1: What is considered a good rent-to-value ratio?

A good ratio typically falls between 6% and 8% for balanced returns. Investors often prefer above 8%, while renters should look for below 6% to ensure fair value.

Q2: Is it better to rent or buy if the percentage is high?

If the percentage is high (e.g., above 8–10%), renting may be costly relative to ownership. In such cases, buying may offer better long-term financial benefits.

Q3: Why are luxury homes often poor rental investments?

Luxury homes usually have low rent-to-value ratios because home prices increase more rapidly than rental demand. This makes them less attractive for rental income but better for capital appreciation.

Q4: How do interest rates affect this ratio?

Higher interest rates increase mortgage costs, making renting more attractive. Conversely, when interest rates drop, homeownership becomes more appealing compared to renting.

Q5: Can rent-to-value ratios predict housing bubbles?

Yes, unusually low rental yields compared to high home values can signal overvaluation in the housing market, which may precede a bubble.

Conclusion

Rent as a percentage of home value is a vital tool for renters, buyers, and investors alike. It provides a quick yet powerful way to compare affordability, evaluate rental income potential, and understand housing market trends. While percentages vary based on location, property type, and economic conditions, knowing the benchmarks empowers individuals to make smarter housing and financial decisions.

For renters, this metric helps determine whether they are overpaying. For buyers, it highlights whether ownership is more cost-effective than renting. And for investors, it serves as a key measure of profitability.

By carefully analyzing rent-to-value ratios and applying them to real-world situations, you can navigate the housing market more confidently and make decisions that align with both your lifestyle and financial goals.